In the last one-year, non-fungible tokens (NFTs) have gained popularity between brands as well as consumers. Chainalysis – blockchain data platform tracked NFTs made news for exponential sales from just $106 million sales in 2020 to $44.2 billion in 2021.

However, as is the case with any new technology, NFTs offer potential for abuse. Chainalysis, a blockchain research firm, recently published its Crypto Crime Report for 2022. Among many other findings, the report stated Two forms of illicit activity observed in NFTs are

- Wash trading to artificially increase the value of NFTs

- Money laundering through the purchase of NFTs

What Is a Non-Fungible Token Or NFT?

Nonfungible tokens, or NFTs, are verifiably unique representations of digital and physical goods. It’s generally built using the same kind of programming as cryptocurrency, like Bitcoin or Ethereum, but that’s where the similarity ends.

Fungible, Physical money and cryptocurrencies are “fungible,” meaning they can be traded or exchanged for one another. They’re also equal in value—one dollar is always worth another dollar; one Bitcoin is always equal to another Bitcoin. Crypto’s fungibility makes it a trusted means of conducting transactions on the blockchain.

NFTs are different. Each has a digital signature that makes it impossible for NFTs to be exchanged for or equal to one another (hence, non-fungible).

A Non-Fungible Token is a digital token that can’t be replaced – it’s unique, just like the Picasso.

The “Femme au béret et à la robe quadrillée (Marie-Thérèse Walter)”, painted by Pablo Picasso in 1937 and last sold in 2018 for a touch under £50 million

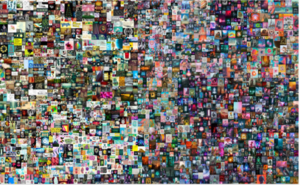

Famous digital artist Mike Winklemann, better known as “Beeple,” crafted a composite of 5,000 daily drawings to create perhaps the most famous NFT of 2021, “EVERYDAYS: The First 5000 Days,” which sold at Christie’s for a record-breaking $69.3 million.

Anyone can view the individual images—or even the entire collage of images online for free. So why are people willing to spend millions on something they could easily screenshot or download?

While it may sound strange or unwise to buy just a jpeg, what constitutes art is in the eye of the beholder. With the art world, booming asset prices and lockdown savings fuelling interest in NFTs, perhaps the artist, Winkelmann explains it best: “Honestly, at the end of the day, if somebody will pay for it, then you can sell it.”

Because an NFT allows the buyer to own the original item. Not only that, it contains built-in authentication, which serves as proof of ownership. Collectors value those “digital bragging rights” almost more than the item itself.

How are NFTs being used to wash money?

Wash trading occurs when a trader or investor buys and sells the same securities multiple times in a short period to deceive other market participants about an asset’s price or liquidity.

Several NFT trading platforms allow users to trade by simply connecting their wallets to the platform without identifying themselves. This means that one user can create and link multiple wallets to a platform.

A user can then control both sides of an NFT trade, selling the NFT from one wallet and purchasing it from another. When multiple such transactions are executed, the trade volume rises. This makes the underlying asset seem highly sought after. Some wash traders have gone to the extent of making hundreds of transactions through their self-controlled wallets.

Ways to prevent wash trading:

- NFT wash trading can be traced by following sales of NFTs to addresses that are self-financed.

- Self-financed addresses are those that are funded either by the selling address or by the address that initially funded the selling address.

- Anti-fraud regulations need to be enforced in the NFT marketplace just like conventional trading domain.

How are NFTs being used to launder money?

Long before NFTs existed, fine art has been used as a store of value, and with that comes a long history of Money Laundering. Unlike with other assets, like stocks or gold, the value of an artwork is highly subjective to the viewer or owner.

This malicious practice is very common in world of art. Art pieces like paintings are easy to move, have relatively subjective prices, and may offer certain tax advantages. Criminals can therefore purchase art with illegally gained funds, sell them later, and poof — they have seemingly clean money with no connection to the original criminal activity.

So, how are NFTs used for money laundering?

- The criminal organization creates a unique NFT and advertises it on an NFT marketplace.

- The criminal organization purchases its own NFT from the NFT marketplace, using an identity that obscures its link to itself.

- Repeat.

An organization using NFTs to clean money will likely use a large network of cryptocurrency wallets and may even attempt to move the proceeds through a cryptocurrency exchange to add more steps between themselves and the final wallet (where the crypto will be swapped out for fiat currency).

Once the NFT has been “traded” a few times, the associated cryptocurrency is “clean.” Furthermore, even though blockchain technology means that tracing the original selling wallet is a doddle, figuring out who actually owns the wallet is entirely different. Know Your Customer (KYC) and Anti Money Laundering (AML) regulations aren’t available on all NFT marketplaces and as such, anyone can open an account, make a sale, and keep their identity hidden.

Why NFTs are attractive for Money Laundering:

NFTs essentially are digital artworks and therefore have the same traits as conventional art. In addition, NFTs come with the benefit of being fully digital, making them much easier to trade compared to moving physical art. However, the trait that makes NFTs particularly attractive for Money Laundering purposes are the volatile prices. While the exchange rate of Bitcoin to EUR follows the market principles of supply and demand, the prices of NFTs are highly speculative. In practice, a NFT that was just bought for 1 EUR can be sold for 1 million EUR the next day. This makes NFTs attractive for laundering black money through legitimate transactions.

Ways to prevent Money Laundering:

- NFTs are also susceptible to such exploits, but the transparent blockchain technology makes it easier to detect and accurately estimate the laundered money in NFTs.

- Money laundering needs to be monitored meticulously by marketplaces, regulators and law enforcement.

US Treasury issues Report- Money laundering risks associated with NFTs

A recently released study by the US Treasury Department, “Study of the Facilitation of Money Laundering and Terror Finance Through the Trade in Works of Art” triggered by concerns that money laundering in the art market could fund terror organisations, found that the booming NFT (non-fungible token) market could be a target for criminals wanting to scrub ill-gained funds into shiny clean legitimacy.

The Report highlights AML/CFT risks specific to NFTs:

- NFTs can be used for “self-laundering,” a process by which illicit actors purchase a NFT with illegally obtained funds, transact with themselves to create a record of ownership, then sell the NFT to a consumer for “clean” funds.

- NFT traders can conduct sales peer-to-peer, without the need for an intermediary. Since the transactions can be executed instantaneously, the process is attractive for criminals that want to covertly transfer assets across borders.

- NFT trading platforms create revenue through transaction fees from NFT sales, incentivizing platforms to design a market in which one NFT may be traded repeatedly over a short period generating higher fees.

- The motivations for traditional art dealers to conduct due diligence (e.g., to ensure customer creditworthiness and maintain a strong industry reputation) do not apply to digital art platforms. Smart contracts (and not the platforms themselves) often govern the transfer of NFTs. If the smart contracts are structured to generate revenue with each NFT transfer, they may increase the risk of repeated transactions in a short period and impede the ability to conduct due diligence.

To date, regulation of NFT traders and trading platforms has been virtually nonexistent. However, the Report’s detailed description of the AML/CFT risks arising from the digital art market may foreshadow additional regulation in this space, and companies should closely monitor developments.

Further, the Report appears to suggest that platforms facilitating transactions involving certain NFTs or digital art could already be subject to FinCEN regulation in two ways:

- First, NFTs used as payment or investment instruments could be classified as virtual assets as defined by the Financial Action Task Force (an intergovernmental body that sets international standards for AML/CFT matters). Platforms that facilitate transactions involving such NFTs could qualify as virtual asset service providers subject to FinCEN regulation.

- Second, those “doing business transferring virtual assets during the buying and selling of NFTs” may qualify as money service businesses subject to FinCEN regulation if they are conducting business within the United States. In support of this proposition, the Report points to the AML Act’s broadening of the definition of financial institution to include “business[es] engaged in the exchange of currency, funds, or value that substitutes for currency or funds.”

Entities that deal with NFTs or other digital art should consider proactively implementing a compliance program sufficient to satisfy the BSA’s requirements. If FinCEN attempts to regulate digital art under existing authority or by broadly defining “antiquities” to include digital art, those involved in the exchange of NFTs will need to implement a compliance program sufficient to comply with the BSA’s requirements, including

(1) designation of a compliance officer.

(2) maintenance of an internal compliance control system.

(3) ongoing employee training.

(4) independent testing and review.

Source:

https://home.treasury.gov/system/files/136/Treasury_Study_WoA.pdf

Alia Noor (FCMA, CIMA, MBA, GCC VAT Comp Dip, Oxford fintech programme, COSO Framework)

Associate PartnerAhmad Alagbari Chartered Accountants